Precision Wealth Market Cycle of Emotions Philosophy

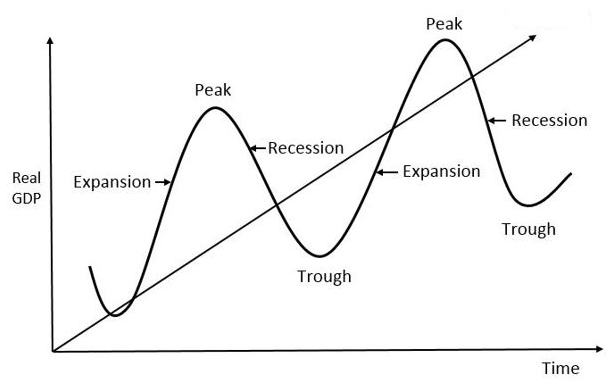

Investment Markets and the Economy at large typically follow a cyclical business pattern that moves up and down like a sine wave as it trends upward over time. This is a cycle that has weaved its way through many expansions, peaks, recessions, and troughs that can be clearly seen in the numerous booms and busts of the 20th century. In fact, some experts estimate that since 1929 there have been 28 distinct market cycles. Expansionary periods generate substantial optimism, while recessionary periods play into our fearful side. This range of emotions can work to an investor’s detriment if a long-term perspective is not maintained.

This outlines the need for two specific disciplines to be applied to your investment approach. First, a stay the course discipline that includes a long-term view with an understanding that downturns will occur as part of the natural cycle. And second, a disciplined review of where we sit today within the market cycle. Said another way, our investment approach should be informed by a continual review of where we believe we are within the cycle, leading to a grounded perspective regarding where we should potentially be overweight and underweight. It is important to note that an opinion as to where we are in the cycle should not drive whether or not to be invested, but rather how to prudently be invested given our perceived location on the curve.

The Need for a Long Term View

As much as we may try to emotionless and rational decisions, investing involves emotion. Studies have shown that most people have a more pronounced negative response to loss as compared to the intensity of their positive response to gains. In other words, most of us feel the losses more than we celebrate the gains. At the same time, there are factors such as FOMO (Fear Of Missing Out) that can draw investors into too aggressive of a posture at just the wrong time. This is where a trusted advisory team can bring value in helping investors to see the big picture and adhere to a long-term investment approach.

The Market Cycle of Emotions

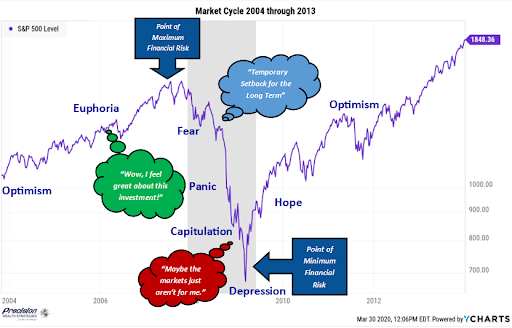

Because investing involves emotions we have to manage and prepare for the emotional side of investing. The graphic to the right illustrates the roller coaster of emotions that most investors experience during the average market cycle. These emotional swings can be dramatic and include Optimism, Euphoria, Fear, Panic, Capitulation, Depression, Hope and back to Optimism. Our team has carefully analyzed 20+ years of historic data in an attempt to optimize allocation adjustments based on the market cycle within both our Fixed Income and Equity models. In our study of history we identified five key emotional phases of the market cycle that we use to guide us in transitioning our portfolio through the emotional ups and downs. These five phases are outlined in detail below. It is important to note that our approach does not require that we correctly call the timing of each phase of the cycle but rather, as long as we are generally within a phase of where the market is then we will be in a reasonable posture for what may follow.

- Optimism – We view Optimism as the intrinsic disposition or natural state for the market. As such the longest amount of time is generally spent in the Optimism phase. The Optimism period is generally measured in years rather than months.

- Euphoria – We reach Euphoria when a Bull market has become mature and valuations are moving to the higher end of the historic range. There are multiple metrics we use to gauge when we are in Euphoria such as the “Buffett Indicator” (Total US market cap relative to US GDP). Euphoria can linger for some time, and like Optimism is usually measured in years rather than months. Euphoria is the point of maximum risk because valuations are high, restraint is low, and Euphoria will inevitably end with a decline in the markets. This is a time when investment management is arguably most important.

- Panic – Typically a phase that comes on quickly and can be precipitous in its decline. During Panic, selling can become irrational and correlations often increase as multiple asset classes move down at once. Historically Panic has been the shortest phase as it is usually a few months or less.

- Capitulation – This is the point at which some investors are tempted to pull the plug on investing in the markets altogether. Feeling that “maybe the markets aren’t for me” many decide to exit at just the wrong time. Capitulation is not necessarily the bottom, but it is usually near the bottom. Capitulation typically lasts months, rather than years.

- Depression – This is a resignation point at which those who have jumped out are out, and those who are still invested have the feeling that I have ridden it this low I might as well stay in. At this point the markets are ripe to turn around, and in fact this is the point of lowest financial risk as it pertains to the market cycle. This is a time to take on a more aggressive posture. In our analysis we deem Depression to last from the market bottom until the point when economic conditions have stabilized and a return to Optimism is the overall mood of investors in general. Depression usually lasts months, rather than years.

Not About Perfection, but Preparation

It is important to reiterate the fact that we will not call each emotional phase of the market precisely. In fact, there will be times when we entirely miss a phase, that is to be expected. We thoughtfully selected five phases so that we create buffers between the strongest movements within the market cycle. Our goal is to stay within one step. For example, we may be in Euphoria, and the market has entered Panic. That is acceptable because Euphoria prepares us for Panic. We would not want to be in Optimism or Depression when the market enters Panic, as our risk exposure would be larger than what we desire it to be.

This discipline of active portfolio adjustments is all about preparation for tomorrow based on an objective and thoughtful view of where we sit in the market cycle today.

Share