Precision Wealth Long Term Investing Philosophy

When we reference Long Term or LT investing at Precision Wealth Strategies we are specifically speaking of investment strategies and models that are intended to be used for the portion of a Client’s overall portfolio that they don’t anticipate needing to draw upon for 10 years or longer.

Using history as a reference, generally speaking when you have 10 years or longer to remain invested, then investing primarily in equities (ownership of company stock directly, or funds containing the stock of a diversified basket of companies) has resulted in a larger return. Restated more concisely, LT investing within our philosophies generally refers to funds that aren’t needed for 10-years or longer, and therefore have time to take advantage of the potential upside that is expected from equity investments over a long time horizon.

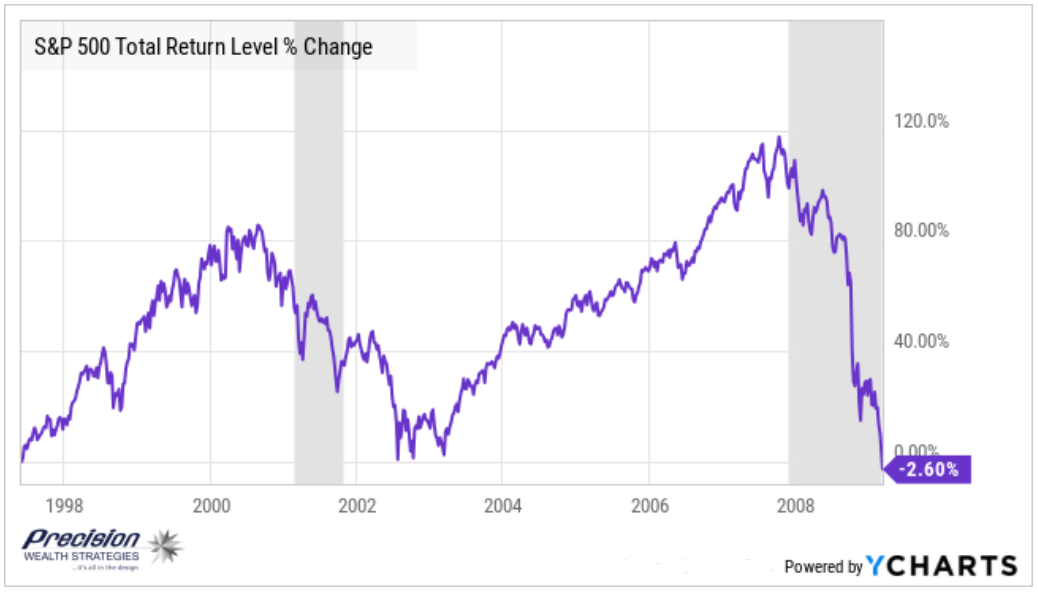

Does this mean that every 10-year period is positive? Unfortunately, no…for instance, at the end of the nearly 22-year period from June 1, 1997 to March 9, 2009 (see chart) the S&P 500 was essentially flat due to the drawdown of the two recessions during decade of the 2000’s (grey shaded periods). At Precision Wealth Strategies we have developed a detailed philosophy around the market cycle to help combat this risk (see Market Cycle of Emotions).

Should every LT portfolio be the same for every person? No, every individual or family is unique and will be in a distinctive stage of life. For example, an individual in their “Accumulation” (building up their savings) years should invest differently from someone in their “Distribution” years (drawing from their savings).

In accumulation, we will be adding to the portfolio. This allows us to buy in when the market experiences dips, taking advantage of Dollar Cost Averaging to help smooth the volatility and improve long term results. Does this allow an accumulator to be more aggressive (higher % in areas like small cap)? We believe yes.

There are other dynamics to consider. Are you someone who is comfortable with a more focused portfolio preferring high conviction around a smaller number of holdings? Or is your preference to lean toward a more diversified portfolio preferring high dispersion to potentially smooth the ride? There are times in which both will win, but at different times.

Transparency: The Key to Our Strategy

As we build out a LT portfolio, we try to maintain a philosophy of transparency. What we mean by transparency is that each model or strategy within your portfolio should have a defined purpose and should be measured against that purpose. We want to avoid your account holdings becoming muddled together in such a way that you can no longer clearly evaluate performance and measure success. For this reason, we at times will establish multiple accounts within your LT portfolio.