End of Q1 Update: Patience, Perspective & Precision’s Process

There is no precedent, at least not in modern times, for what is happening. Beyond the enormous human toll, the abrupt cessation of significant chunks of economic activity, not to mention daily life, these experiences have likely not occurred in our living memory. Adding to the sense of doom: for an industry built on data and forecasts, there are few if any historical examples to provide context. That said, as fiduciaries we need to use what information we do have, while acknowledging what is unknowable, to help investors as best we can. Internally we have been overlaying past significant market downturns to see what we can disseminate.

Navigating the Future by Examining the Past

“The two most powerful warriors are patience and time.” Leo Tolstoy

From a financial perspective the biggest unknown is the near-term trajectory of the global economy. What can be said is that the magnitude of the economic contraction will exceed the worst of the financial crisis. Credible estimates suggest a 10-20% contraction in second quarter GDP. What is less clear is the outlook for the second half of the year. That will be determine by three factors: the path of the virus, duration and severity of the lock-down and efficacy of the stimulus.

In thinking through the implications of the economic collapse, it is important to also weigh two offsetting considerations: Risky assets have already experienced one of the swiftest downward adjustments in financial history and the government response is equally unprecedented.

We have just ended the first quarter of 2020 as one of the worst quarters and therefore one of the worst starts to a calendar year in history, with no doubt in my history. Starting with the financial markets, I will focus on the Dow Jones Industrial Average, not because it is particularly representative of the overall market, but because its longevity affords a unique historical perspective. March 24th, even after Tuesday’s (March 24, 2020) historic rally, the Dow Industrials lost approximately -26%. Going from January’s close through back as far as the late 1890s, the number of declines of this magnitude are exceedingly small. Except for the painful but ephemeral ‘87 crash, there have been no similarly rapid declines since the onset of the Great Depression, nearly 90 years ago.

Not only are markets discounting a die scenario, so now are policy makers. It would take up several pages to list the various programs, each with its own indecipherable acronym, that have been launched in the past week alone, yet you may have seen my ten plus page outline. Suffice to say that the response is larger than anything we’ve seen in the post-WWII era.

Programs & Policies

On the monetary side, the Federal Reserve has committed to open-ended quantitative easing. The Fed, along with most of the world’s other central banks, has dusted off and built upon the financial crisis playbook. On top of that, there are swap lines for foreign central banks in need of dollars, support for the municipal and commercial paper markets, and perhaps most important, loans to small businesses.

On the fiscal side we now have the largest stimulus bill ever, $2 trillion or roughly 9% of GDP with more on the way. And to the extent many of these programs can leverage the Fed’s balance sheet, the $2 trillion number arguably understates the true impact. By way of comparison, the 2008 stimulus bill was approximately $800 billion.

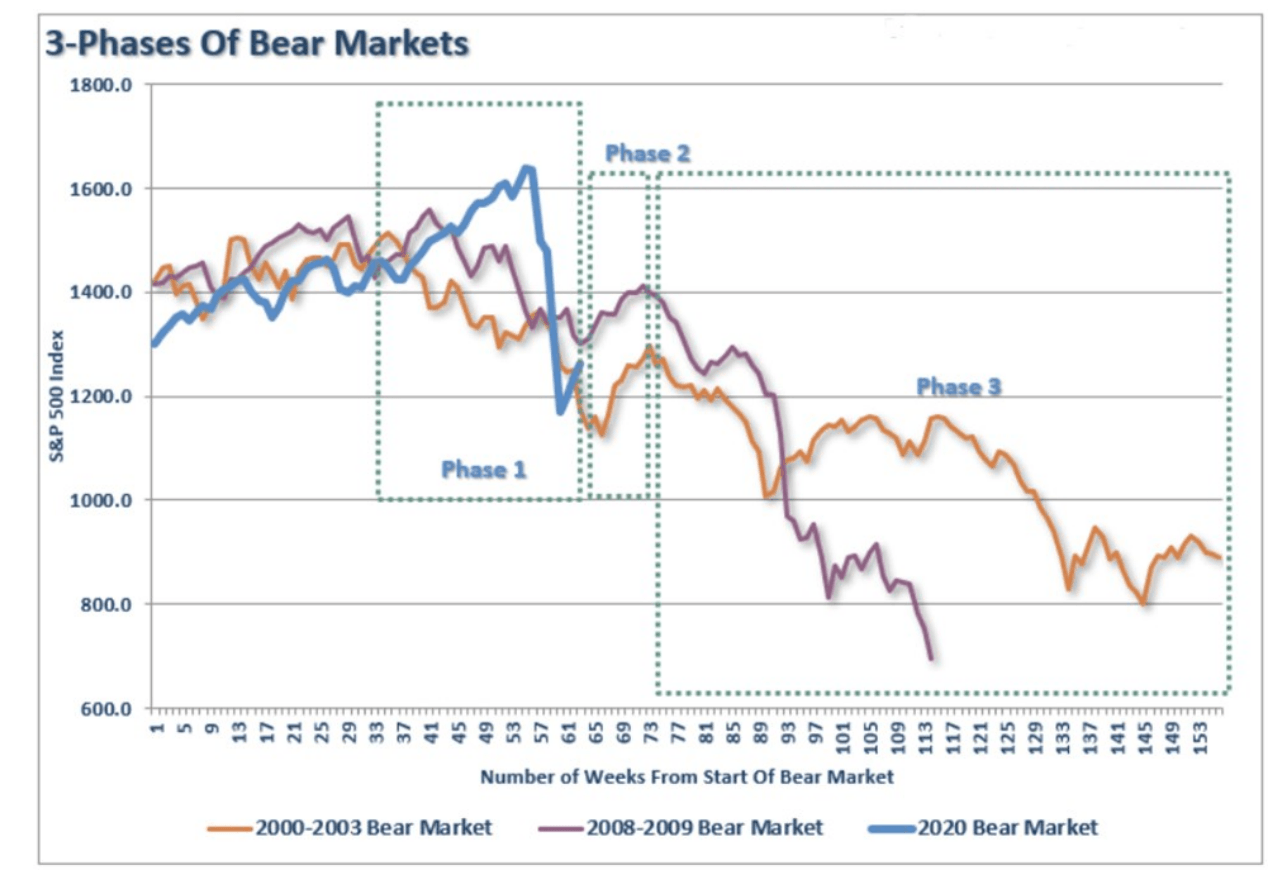

Dow Theory also suggests that bear markets consist of three down legs with reflexive rebounds in between. Take a look at the chart below. There are many signs suggesting we may be entering into Phase 2. There is always a possibility we skip Phase 3 and go right back into prosperity. What phase is complete is the question we are all working on answering now.

Bear market cycles rarely end in a month. While there is a lot of “hope” the Fed’s flood of liquidity can arrest the market decline, there is still a tremendous amount of economic damage to contend with over the months to come. In the end, it does not matter if you are “bullish” or “bearish”. What matters, in terms of achieving long-term investment success, is not necessarily being “right” during the first half of the cycle, but by not being “wrong” during the second half. However, the "bear market" is only one-half of a vastly more important concept - the "Full Market Cycle.”

Analyzing the Full Market Cycle

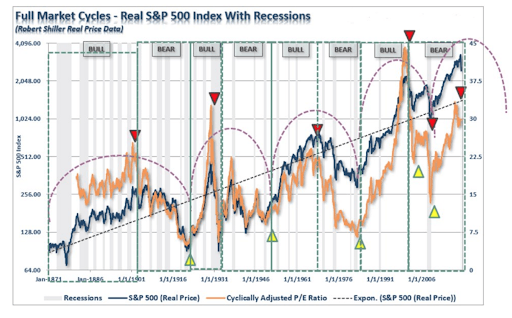

Over the last decade, the media has focused on the bull market, making an assumption that the current trend would last indefinitely. However, throughout history, bull market cycles make up one-half of the “full market” cycle. During every “bull market” cycle, the market and economy build up excesses. In other words, as Sir Isaac Newton discovered, “What goes up, must come down.”

The chart below shows the full market cycles over time. Since the current "full market" cycle is yet to be completed, I’m providing a long-term trend line with the most logical completion and point of the current cycle.

I am not stating the markets are about to crash to the 1600 level on the S&P 500, yet the 1600 level is not out of the question either. The famous investor Jack Bogle stated that over the next decade we are likely to see more 50% declines. A 50% decline from the all-time highs would put the market at 1600. This is why we are putting hedges in place.

Neither the magnitude of the decline nor the size of the stimulus package guarantees a near-term bottom. Investors are unlikely to consistently and confidently return for more than a trade until there is better visibility, both as to the progress of the disease and duration of the economic constraints. Until then, the new paradigm of +10% daily swings is likely to continue. But while we are clearly not at the end of the panic, to paraphrase Churchill, we are probably at the end of the beginning. Given where we’re at, I believe the best we can do is to maintain a a sense of perspective. As a society, we have faced worse: civil war, a global, multi-year depression and two devastating world wars. We will get through this.

The following will lay out your returns for this memorable, though not pleasant, first quarter. Reporting negative news is not enjoyable for me, the reporter or the adviser. I started the report off with some quotes on Patience. We will get through this. The Precision Team is working tirelessly to provide a reduction of further downturn in your accounts while also making sure we are prepared to capture the inevitable return. What phase we are in and how long we will experience these times is unknown, yet we will get through this and get through it together. We appreciate you, your friendship, confidence, patience and perspective. We will get through this. Stay safe, stay healthy and don’t hesitate to reach out to us.